Although they are related, these two payments are not the same as the financial instrument known as an annuity. An allowance due is the inverse of a regular annuity, in which payments are made at the start of each term. While payments in an ordinary annuity might be made as frequently as once per week, they are usually made monthly, quarterly, semi-annually, or annually.

#Coefficient of variation easycalculator series

It is important to understand the coefficient of variation formula concept because it allows an investor to assess the risk or volatility compared to the expected return from the investment. Therefore, the coefficient for Apple Inc.’s stock price for the given period is 0.0501, which can also express the standard deviation of 5.01% of the mean. The detailed calculation is in the last section of the article) Mean stock price = Sum of stock prices / Number of days (add up all the stock prices and divide by the number of days. read more stock price for the period can be as, There are primarily two ways: arithmetic mean, where all the numbers are added and divided by their weight, and in geometric mean, we multiply the numbers together, take the Nth root and subtract it with one. On the based of the stock prices mentioned above, we can calculate the mean Calculate The Mean Mean refers to the mathematical average calculated for two or more values.

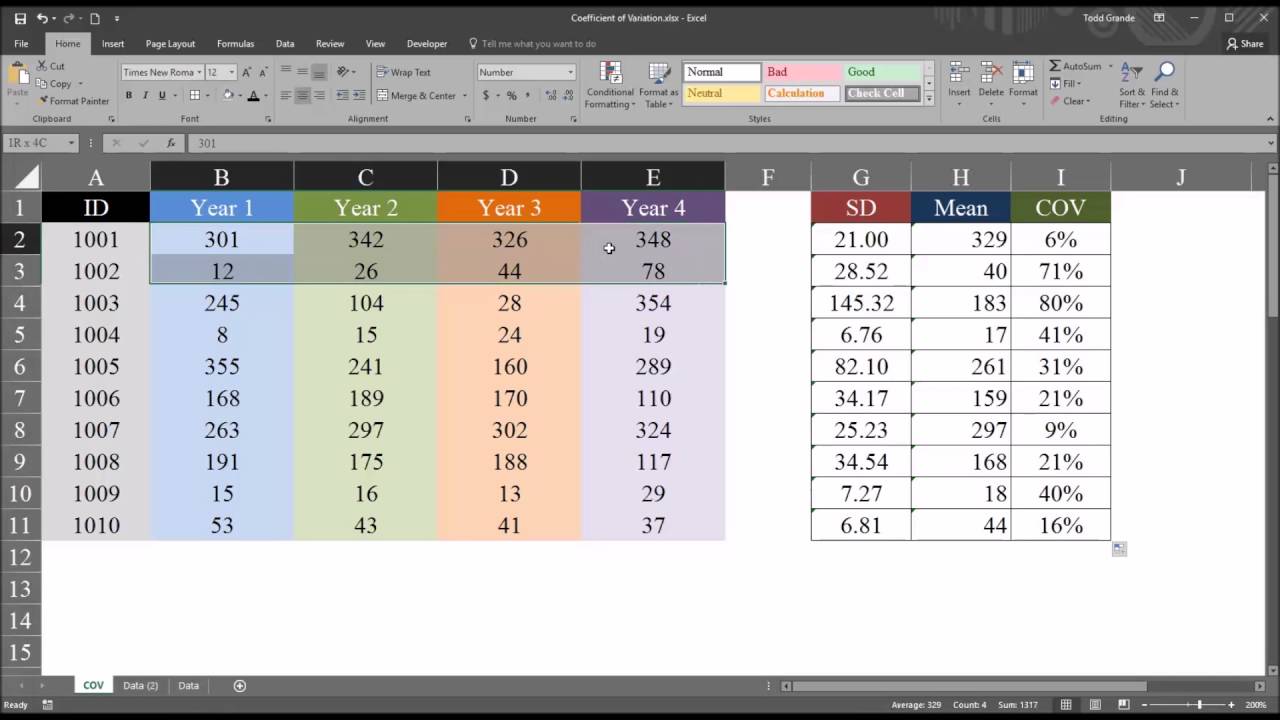

Below is data for calculating the coefficient of variation of Apple Inc.īelow is data for calculation of the coefficient of variation of Apple Inc’s Then, calculate the coefficient of variation for Apple Inc.’s stock price for the given period. Take the example of Apple Inc.’s stock price movement from January 14, 2019, to February 13, 2019. Since the coefficient of variation is the standard deviation divided by the mean, divide the cell containing the standard deviation by the cell containing the mean.

#Coefficient of variation easycalculator download

You can download this Coefficient of Variation Formula Excel Template here – Coefficient of Variation Formula Excel Template

0 kommentar(er)

0 kommentar(er)